I agree that we should eliminate as much of the withdrawal fee as we can beyond covering gas and other necessary costs. In the coming world of single-digit safe farming APYs, .5% will become a critical liability with large depositors and leave us vulnerable to losing the majority of TVL in less than a day. Beyond trust and safety, which we will fortunately never monopolize, the only competitive advantage yearn will be able to maintain for years on basic deposit strategies is the sustainably lowest total fee. The protocol’s reputation will be better served by eliminating as many fees as we can before the decision is forced upon us to survive. Lower earnings this year = much higher earnings in 2021 and beyond.

I think we should strive to be the Vanguard of DeFi and charge the lowest fees to attract the most loyal customers out there. Then let the strategies earnings speak for themselves. I think this would be the most prudent direction to go in.

I am also in favor of removing the withdrawal fees. Also in favor of a performance fee on profits attributable to the strategy. Profits should be determined after any gas costs.

You could make i t a performance fee then. Either way, those active in the community also need to be properly incentivized for governing and otherwise supporting the community.

This is a terrible idea. The fees that you are speaking of (2% of AUM every year) are actually the way in which many of these funds end up gobbling up much of the assets they are managing. You cannot really compare a super risky asset like Yearn Finance to a relatively safe passive investment fund like a Vanguard fund. A better comparison would be to a VC fund which has a structure where they take 2% every year and they take 20-40% of the carry (profits). The result is that the VC partners make tons of money and the investors and founders are the ones left to hold the bag. This has also incentivized the building of massive VC funds with tons of AUM so that they can collect tons of fees rather than focusing on actually making good investments. I don’t think we want to create any of these incentives for Yearn.

If anything I think a pure performance fee is way better, but I actually prefer as minimal of fees as possible. I am a YFI holder but I am just tired of the ways traditional finance screws everyone over and I want to stay as far away from that as possible.

I think the Amazon approach of barely breaking even on what is being sold to promote expansion is most likely to promote appreciation of YFI, not increasing dividends during the high growth stage of both this project and the broader industry.

My opinion is subject to two caveats. First, small fees that incentivize contimuing use of YFI by end users and dissuading conduct that undermines strategies (e.g., fee on deployed funds, but not non-deployed funds in the vault) should not be rejected out of hand. Second, sufficient fees to ensure non-nominal distributions to YFI holders continue, not necessarily because YFI holders should view current distributions as a source of significant profits, but to maintain a pro-dividends Schelling point for way down the road, after the growth stage begins to subside, which will allow the community to revisit this issue.

This is the reason i left. Nothing but risk to a dramatic downside to the holder and getting paid nothing to hold it.

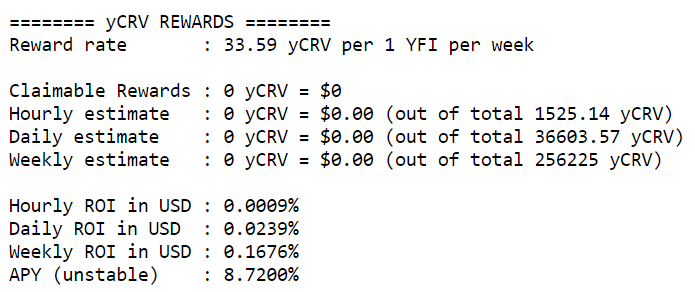

YFI holders are paid to hold the token– they make 5% on the harvest() calls and 0.5% on withdrawals, assuming funds need to be pulled from the strategy.

Thanks. That is much better…where can this be tracked?

I don’t like the Blackrock comparison. This is crypto and implies free to wander a new path. I understand costs need to be addressed and maybe a small fractional compensation( less than 1%) could be levied in line with .

Got all outfitted and staked my tokens after your clarity was given. Thanks again for taking the time to send this to me…its the little things that make great organizations great!

Warmest Regards

After reading through the complete discussion, the general notion seems to be:

- simple fee structure (preferably only 1 fee)

- mostly in favor of performance fee because no risk for the principal

- keep the fee low to sustain and grow the user base

For the most part I agree. There is no need for complicated fee structures and a performance fee appears to be the fairest. I haven´t met anyone yet who would not be ready to pay a small fee for a useful and wildly profitable service.

When it comes to the fee amount, it really depends on what we use it for. If it´s just a dividend for the YFI holders, this makes no sense at this stage (growth is king!) and it would seriously harm yearn.

But if we want to undertake projects that need strong funding, the money needs to come from somewhere. Recently I read about the auditing yAcademy which is a brilliant idea and let´s also not forget about the native insurance proposal (Proposal: Direct % of rewards towards socialized insurance fund). These things need serious funding but they also add tremendous long term value to the protocoll. Therefore, I suggest a performance fee in the range of 10-20% which should be lowered when funding progresses to a certain point. Yes it appears high but it´s used for creating enduser value, so that´s key.

Although yearn is in a good starting position, we are far from having won the game. The race just started and we need to move fast. Funding lets us move faster.

@DeFiChad Agreed, but what is the point of rapid funding if we aren’t organized efficiently? There still seems to be a bit of information arbitrage between ‘insiders’, and the general community. Yearn is still quite fragmented and confusing for most users – plus the average user likely doesn’t have a clue about products that are being built on the back-end. Even if we increased funding dramatically, how would we allocate that efficiently? I don’t think we would with our current structure.

I completely agree that growth is king. I would be in favor of one simple fee, a performance fee. But I would prefer the fee much lower, something closer to 5% seems fair to me.

You raise a good point concerning the internal organization and lack of clarity. An organization chart that is pinned in the forum and linked on the website would go a long way. And yes, I know this is not a company. Nevertheless, this community as well as the decision and execution processes are somewhat structured and it needs to be clear how.

To your point regarding the funding: it needs to be clear for what we use the funds before we raise fees. If we decide to do some sort of in-house insurance - which seems to be appreciated by most - it could literally absorb any funding we throw at it like a black hole. So I´m not too concerned that we wouldn´t know what to do with the money anytime soon.

By doing a quick and dirty approximation, fee rewards for token holders would actually pale in comparison to “insurance rewards” once the spill-over kicks in which I described here Proposal: Direct % of rewards towards socialized insurance fund

In other words, someday yearn could operate with zero fees to the users while still having always enough funds for development of new awesome services and incentivize governance. If that isn´t the ultimate killer against copy cats I don´t know what is.

From the post on v2 vaults, it looks like pricing is moving towards an AUM fee of 1% (50bp that is split among governance stakers and a strategy creator fee of another 50bp). So users see a total of 1% fees on deposits, but only half go to governance. Helpful for cash flow projections for stakers and also for funding of insurance and other initiatives being proposed @DeFiChad

@ejbaraza Well said! ,

BETTER !

we are the Bridgewater Associates of Defi

We are breaking down the “Holy Grail” of open finance,

A sweet spot between diversification and correlation,

with one of the best investment philosophy products setups

''All weather’s" battle-tested product offer in this space.

According to Banteg we are moving towards a v2 vault with 20 different strategies with a weighted average APY of 20% and a 2% AUM fee and 10% performance fee. Also, they want to increase the size of the treasury to $5 million in order to attract/keep code devs and pay half the performance fee to the strategy devs. I don’t know how they are going to determine the fee structure on the yPools since they may incur an impermanent loss.

I think stratagies need to by devloped by community members and there should be q a clear end game to each strategy. Crypto and the blockchain are moving faster than I envisioned into the mainstream, and I hope we do not get so profit crazed that Wall Street and their Billions gobble up crypto, again leaving the poor and our youth with almost no way to rise above their station. . I recall so many friends telling me “BTC will never reach the value of one oz of gold.” At the same time I have lost a great deal to scams or outright failures but thankfully made far more.